Most companies brag about “data-driven decisions,” yet CFOs still spend quarter-end stitching spreadsheets. The culprit isn’t lazy analysts; it’s brittle architecture. This blueprint shows GTM leaders how to replace snapshot dashboards with a living revenue nervous system—one that ingests every buying signal once, models it centrally, and feeds humans and algorithms in real time.

The Illusion of Insight

Leaders often assume that adding another dashboard will fix forecasting pain. In reality, more visualisations on top of mismatched data only amplify confusion. Forrester estimates that 60 – 73 percent of enterprise data goes unused for analytics, proving that volume alone doesn’t create insight.

Why Dashboards Fail the Boardroom Test

C-suite questions such as “Which region will miss?” or “Which segment is over-budget?” require context across systems. Dashboards pull partial slices that are already stale. A 2023 KPMG survey found nearly half of large companies still rely on spreadsheets for critical reporting despite multi-million-dollar BI investments. When executives export, trust in the official numbers collapses.

Data Lake ≠ Data Product

Buying another terabyte of object storage is cheap; creating an always-accurate data product is not. A data product behaves like software: versioned, documented, and governed. Unmodelled “lakes” turn into what engineers call a data swamp: raw events with no contract, impossible to reuse. That swamp is why dashboards drift and machine-learning pilots stall.

The Four-Layer Revenue Backbone

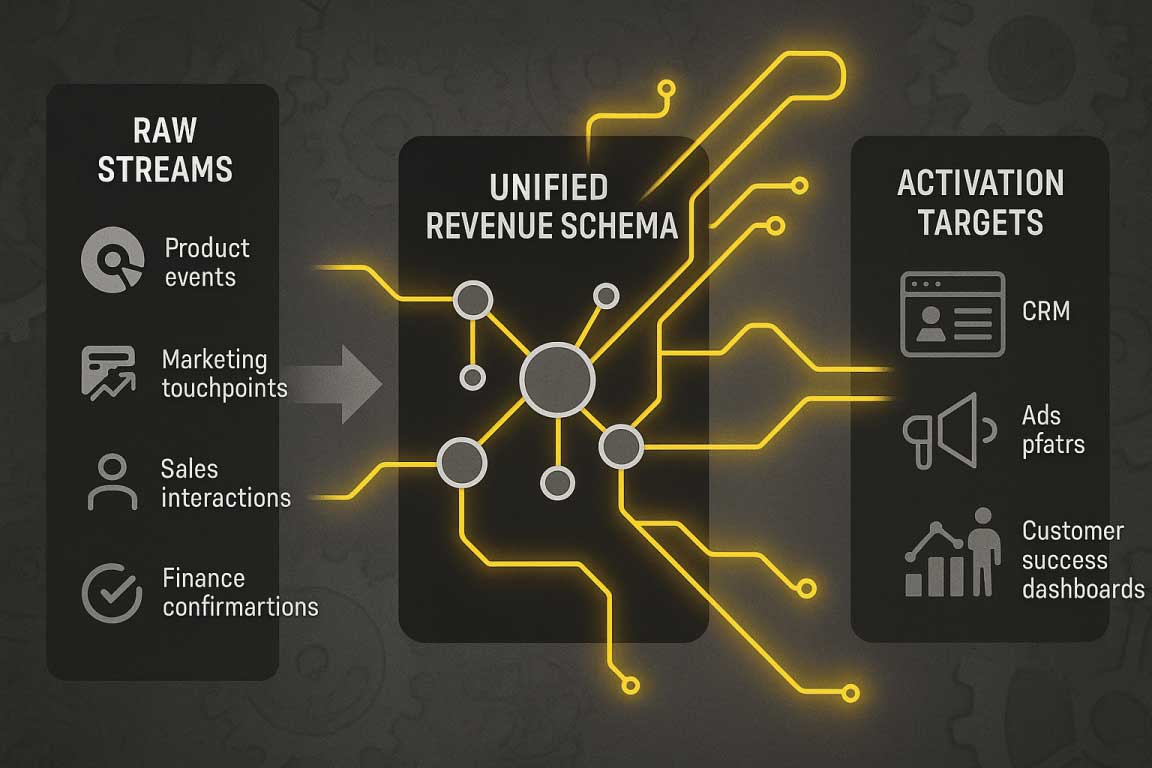

Picture RevOps as the circulatory system for revenue. Blood cells (events) move through arteries (pipelines) into organs (apps) that act. The diagram you downloaded a moment ago visualises four repeatable layers:

1 · Event Collection

You can’t analyse or automate what you never captured. This layer gathers every behavioural and commercial signal as-is—no premature summarising.

- Snowplow or Twilio Segment stream product events with millisecond timestamps.

- Ad APIs and MAPs send marketing touch-points.

- Gong and Outreach push sales interactions.

- ERP systems (e.g., NetSuite) confirm financial events.

Tools like Fivetran and native CDP connectors land those streams in cloud storage within seconds.

2 · Unification & Identity Resolution

Raw logs are worthless until tied to the right person, account, and opportunity. RudderStack and Hightouch run machine-learning classifiers that merge duplicates, link personal and corporate emails, and flag enrichment gaps automatically.

3 · Central Revenue Schema

This is the beating heart: a single set of tables that describes every pipeline stage, contract, and cost. Transformation frameworks such as dbt compile SQL like application code—tested, versioned, and documented—so analytics, attribution, and AI models speak the same language.

4 · Activation & Reverse ETL

Information becomes valuable only when it reaches the front line. Reverse-ETL platforms (Hightouch, Census) sync curated objects back into Salesforce, ad platforms, or customer-success dashboards within minutes. That closes the first half of the loop: data → action.

Where AI Fits—and Where It Doesn’t

Artificial intelligence doesn’t replace modelling discipline; it accelerates it. Two leverage points:

- Classification at Ingest. LLMs label intent in call transcripts and chat logs, enriching events before they hit storage.

- Anomaly Detection. Unsupervised models watch for schema drift, freshness delays, or metric spikes, paging RevOps before executives notice.

Skip schema governance and your AI will automate chaos.

Five Hidden Pitfalls (and How to Dodge Them)

Even elegant diagrams crumble under real-world pressure. Watch for these traps:

- Shadow Schemas. Marketing builds its own objects in a CDP, creating drift from finance.

- Batch Reflex. Overnight jobs feel safe but turn “real time” into “next morning.” Adopt streaming.

- Over-Enrichment. Buying every third-party intent feed adds cost and latency with marginal lift.

- DIY Match Logic. Home-grown fuzzy-match scripts rarely outperform dedicated identity-resolution engines.

- Governance Bolt-On. Privacy and lineage must compile with the model, not sit in a final audit script.

Quick-Start Checklist

Goal: deliver executive-grade answers within 30 days.

- Data Contract. Document one authoritative definition per metric—no synonyms.

- Latency Budget. Set a maximum of five minutes from event to activation.

- SLA Dashboard. Track freshness and error counts alongside revenue KPIs.

- Data Council. Finance, sales, and marketing co-own contracts and break-fix.

- Pilot Question. Pick a single CFO pain point (e.g., “first-meeting-to-close cycle time”) and prove the loop.

Key Moves to Build Momentum

Architecture is a journey, not a Gantt chart milestone. These principles keep stakeholders engaged:

- Model once, activate everywhere. When finance changes a field definition, every downstream app inherits it automatically.

- Design for change, not perfection. Like software, schemas evolve; version them.

- Guardrails before gear. Automate lineage, access control, and testing before flashy ML projects.

And now?

Congratulations—you now have a living revenue backbone. In the next blog - coming on Thursday - we wire AI triggers, attribution feedback, and budget automation that let teams course-correct during the quarter, not after. Stay tuned!